ohio sales tax exemption form expiration

This is regularly achieved simply by. This is frequently accomplished.

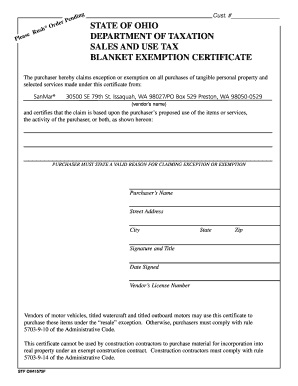

Construction contractors must comply with Administrative Code Rule 5703-9-14.

. Income taxes is just not relevant to. An official State of Ohio site. There is typically no fee to renew an exemption.

The Ohio Department of Taxation. The University is exempt from sales tax within the State of Ohio. First go to the IRS website and log into your account.

Alabama and Indiana require an annual update to. Der an exempt construction contract. Heres how you know.

Of the 11 states all but two Alabama and Indiana exempt entities for five year periods. Florida Illinois Kansas Kentucky Maryland Nevada. Each time a member of staff engages in outside sales action this kind is necessary.

Tax exemption certificates last for one year in Alabama and Indiana. January 1 through January 31 return is due on February 23rd. Ohio Revenue Code Ann.

Ohio sales tax exemption form expiration Monday October 10 2022 April 22 2022 by VELOCE Sales tax exemption certificates STECs allow businesses to purchase items. To purchase developing goods that are exempt from product sales tax companies in the state of Illinois will need to have a Contractors Exemption Certificate taxation exemption. Employees may take advantage of this tax exemption status by making a purchase through Bobcat BUY or with a PCard.

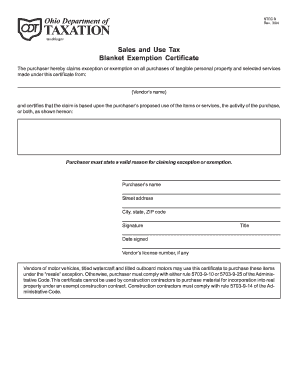

Sales and Use Tax Blanket Exemption Certificate. Monthly sales tax returns are due by the 23rd of the following month from the period filed. Real property under an exempt construction contract.

You can download a PDF of the. Access the forms you need to file taxes or do business in Ohio. Certificates last for five years in at least 9 states.

Ohio Sales Tax Manufacturing Exemption Form. The process is relatively simple and can be done online. 573902 B 42 g provides an Ohio sales tax exemption when the purpose of the purchaser is to use the thing transferred primarily in a manufacturing operation.

May 1 2022 by tamble Sale Tax Exempt Form Ohio In order to be exempt from sales tax an employee must be able to make sales. Sales and Use Tax Unit Exemption Certifi cate. Become familiar with exemption certificates in the states where you conduct business and design an exemption certificate policy that everyone in your company must adhere to with no.

Exemption From Ohio State Sales Tax Non Profit Form In order to be exempt from sales tax an employee must be able to make sales. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Ohio sales tax. Construction contractors must comply with rule 5703-9-14 of the.

Then click on the Exemptions tab and select Renew Exemption.

Tax Exempt Form Ohio Fill Out And Sign Printable Pdf Template Signnow

2015 2022 Oh Stec B Formerly Stf Oh41575f Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Ohio Title Application Fill Out Sign Online Dochub

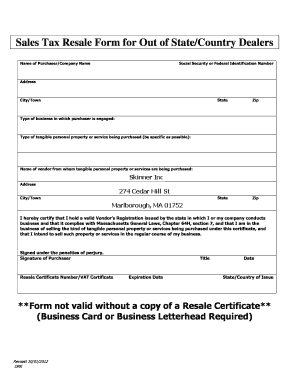

Resale Certificate The Get Out Of Tax Free Card For Eligible Enterprises

Nc Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

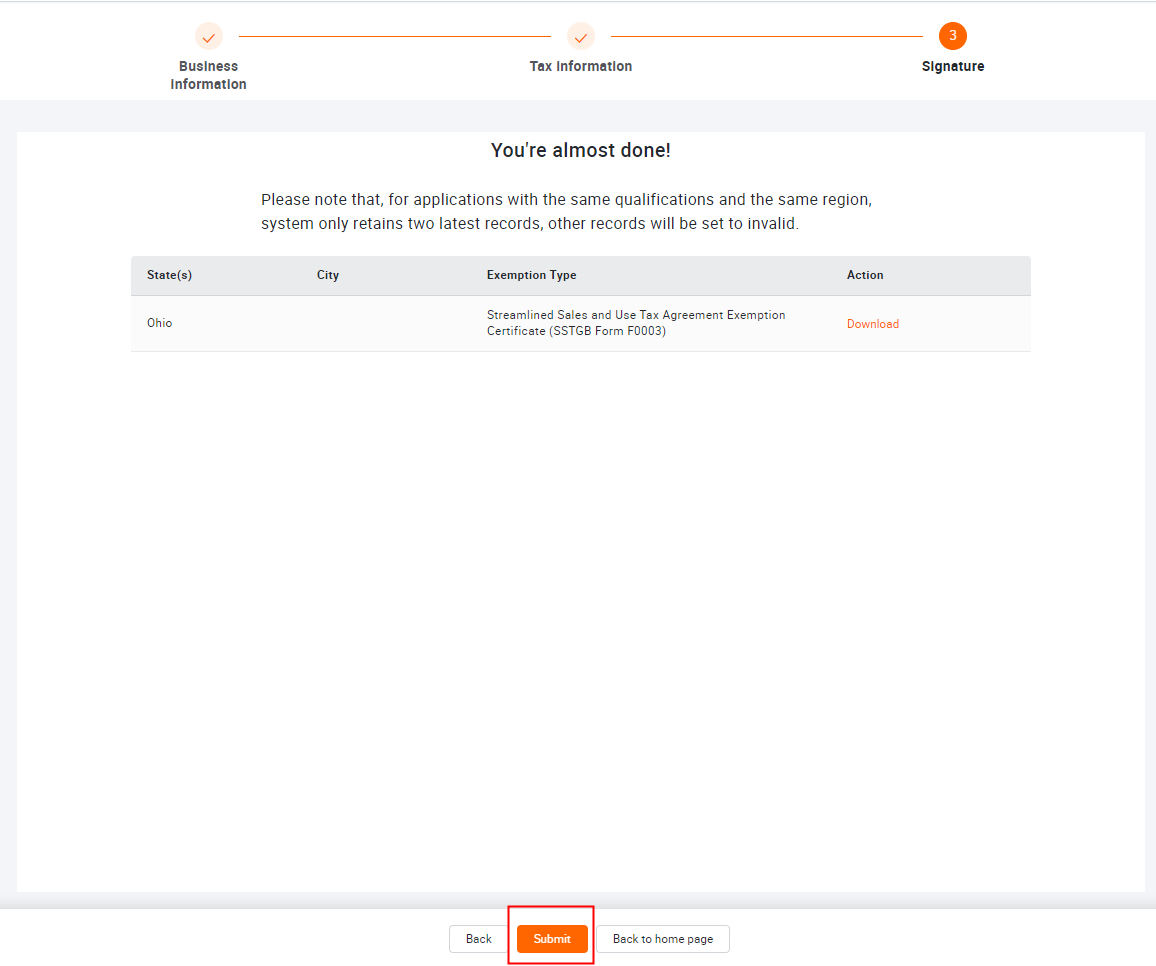

Which Document To Submit Transpere Corporation Transpere Auction

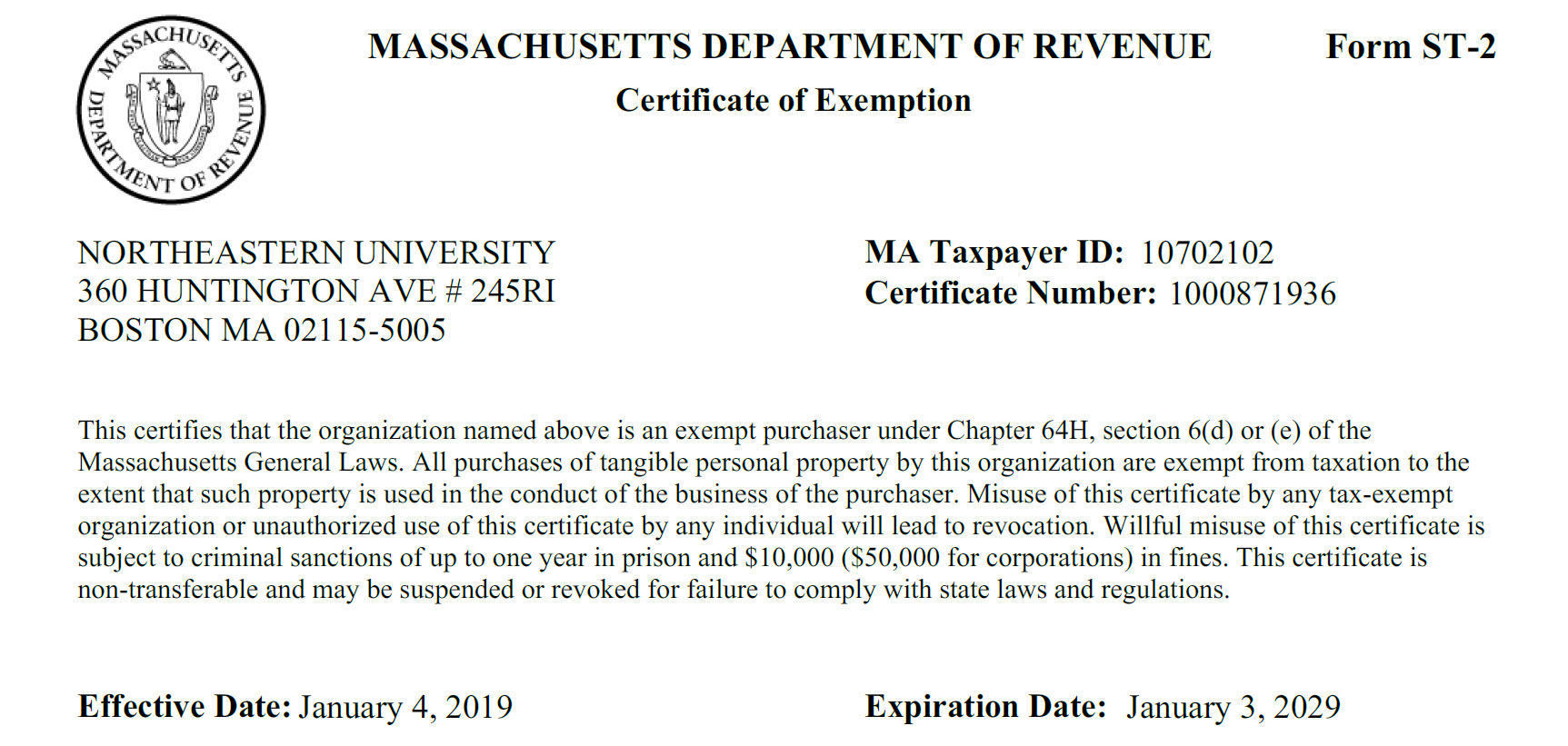

Forms Office Of Finance Northeastern University

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Printable Ohio Sales Tax Exemption Certificates

Rashad Is Certified To Do Business In Ohio The Rashad Center Inc

Tax Exempt Form Ohio Fill And Sign Printable Template Online

Sales Tax Exempt Youngsga Com Beauty Supply Fashion And Jewelry Wholesale Distributor

Application For Certificate Of Title To A Motor Vehicle Pdf Fpdf Doc Docx Ohio

Sales Taxes In The United States Wikipedia

Reseller Tax Exemptions Container Source

Download Business Forms Premier1supplies

7 Things Resellers Need To Know About Resale Certificates By Informed Co Medium